Summary of tax credit under the bipartisan budget act of 2018 which was signed in february 2018 a number of tax credits for residential energy efficiency that had expired at the end of 2016 were renewed.

Asphalt roof put on in 2017 energy credit.

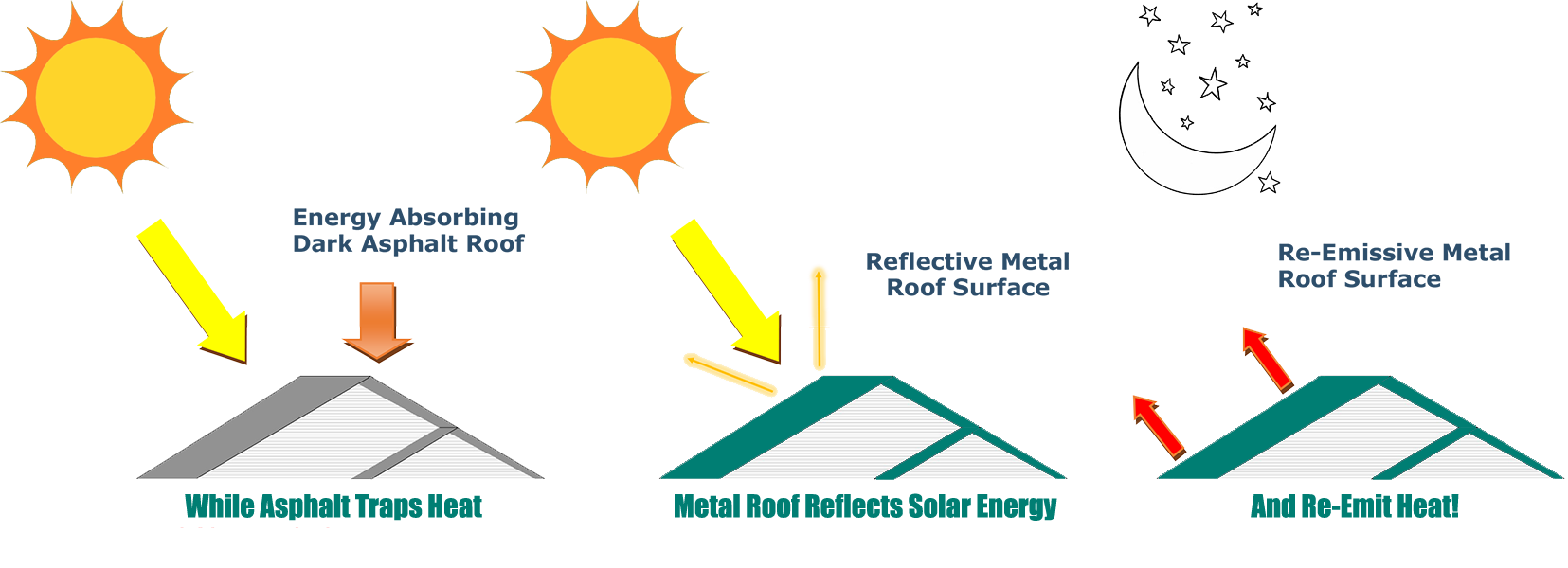

This tax credit is for energy star certified metal and asphalt roofs with pigmented coatings or cooling granules designed to reduce heat gain.

To use it this year on an approved metal roof the homeowner cannot have used it in the past on new windows doors insulation or other energy star certified products and the roof must be.

The 500 credit has a lifetime cap.

The nonbusiness energy property credit expired on december 31 2017 but was retroactively extended for tax years 2018 2019 and 2020 on december 20 2019 as part of the further consolidated appropriations act.

However this credit is limited as follows.

Nonbusiness energy property credit part ii you may be able to take a credit equal to the sum of.

Energy star certified products are independently certified to save energy save money and protect the environment.

The tax credit program was aimed to create jobs in the construction industry while also reducing electricity costs for homeowners.

Any residential energy property costs paid or incurred in 2017.

A tax credit is an amount that a taxpayer can deduct from the amount owed at tax time.

The united states has instituted a federal roofing tax credit which encourages homeowners to re roof with energy star products.

Yes you can include the costs of the roof.

Homeowners may be eligible for a tax credit if they install a more energy efficient roof.

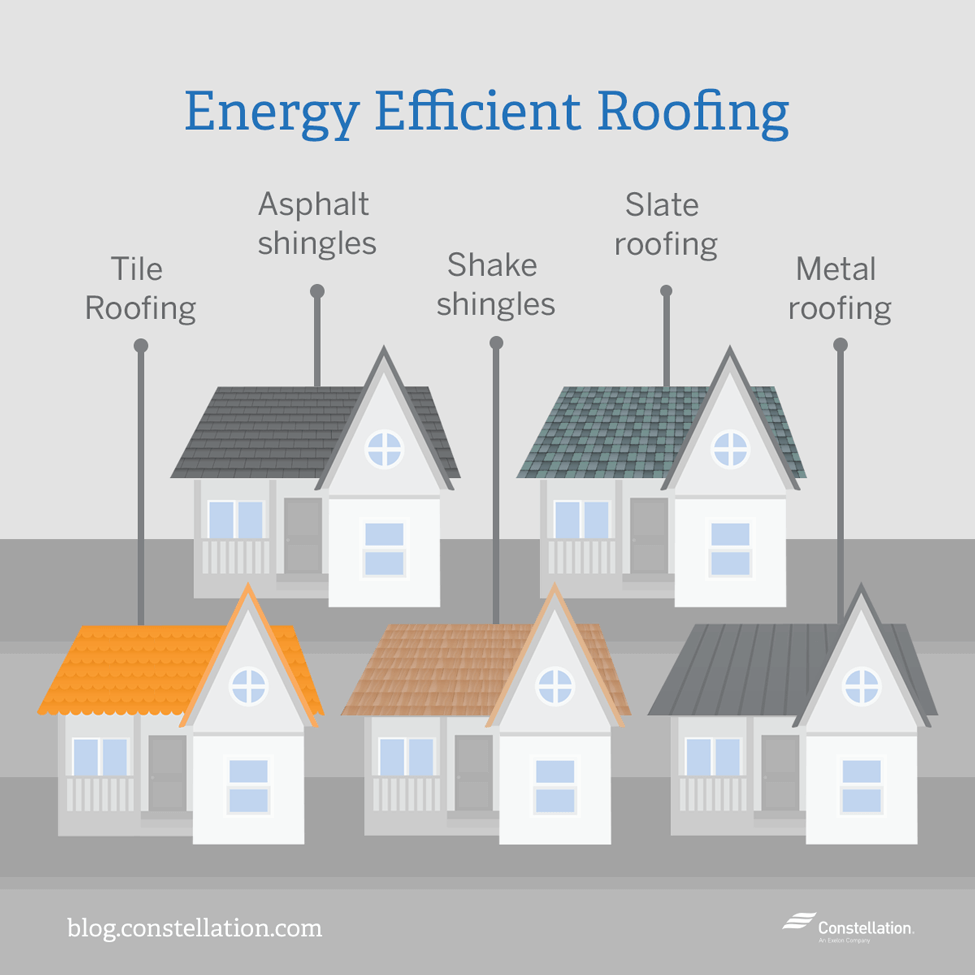

Metal roofs with appropriate pigmented coatings and asphalt roofs with appropriate cooling granules that also meet energy star requirements are eligible.

If you made energy saving improvements to more than one home that you used as a residence during 2017 enter the total of those costs on the applicable line s of form 5695.

10 of the amount paid or incurred for qualified energy efficiency improvements installed during 2017 and 2.

10 of cost note.

You may be able to take a credit of 30 of your costs of qualified solar.

If you are not eligible to take the credit there is nothing to enter for your new roof.

The type of credit you may qualify for is listed in part ii for nonbusiness energy property which allows you to claim up to a 10 percent credit for certain energy saving property that you added.

You must have a manufacturer s certification statement to take the credit.

Roofs metal and asphalt roofing materials that meet energy star requirements reflect more of the sun s rays and can lower roof surface temperatures by up to 100 f.

The consolidated appropriations act 2018 extended the credit through december 2017.

The new roof was needed for the solar installation.

There is a total combined credit limit of 500 for all purchases improvements for all years since 2005.