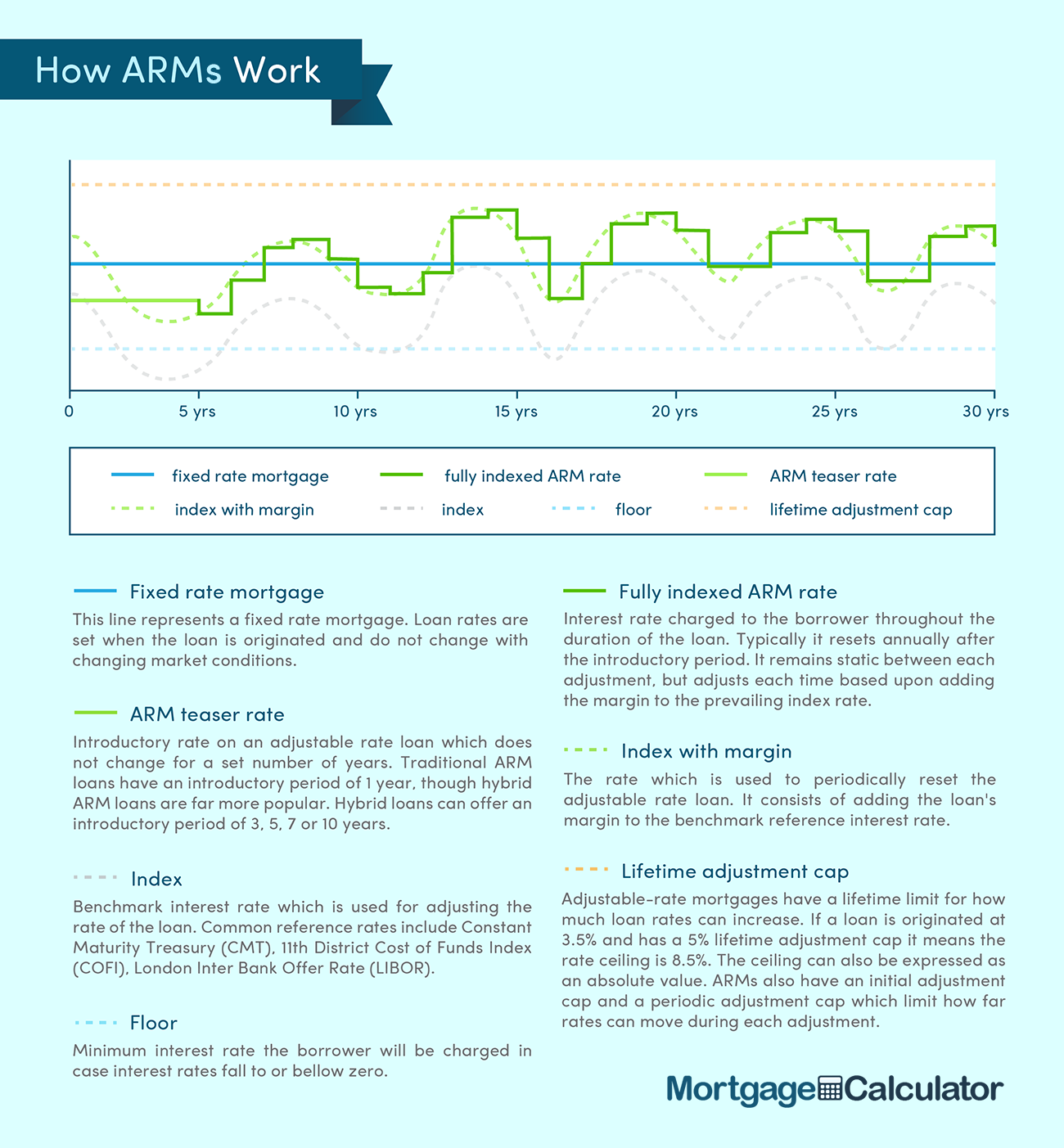

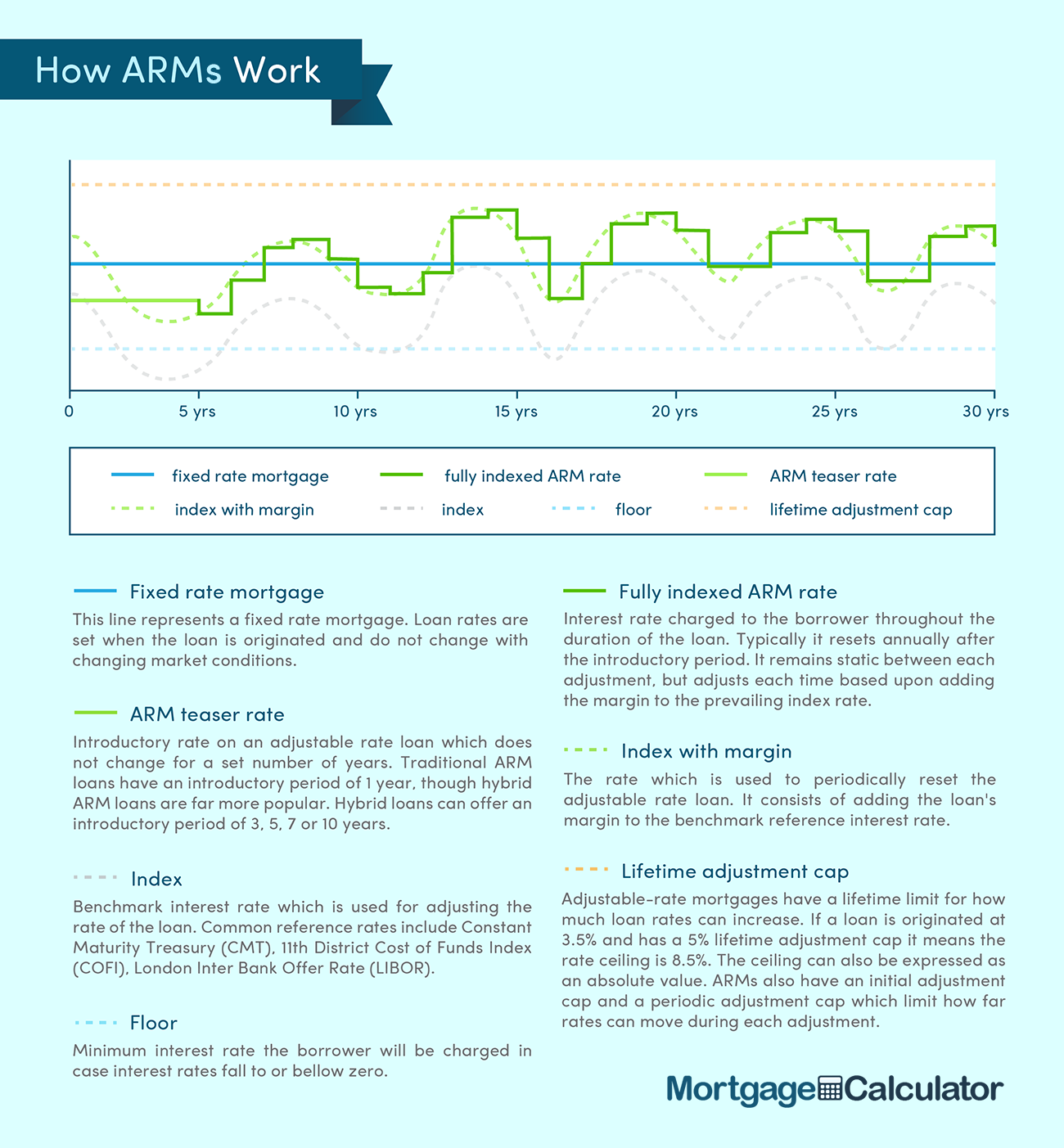

With adjustable rate mortgage caps.

Arm interest rate floor.

Interest rate floors are utilized in derivative contracts and loan.

Check today s arm rates with a qualified lender.

It s common for this cap to be either two or five percent meaning that at the first rate change the new rate can t be more than two or five percentage points higher than the initial rate during the fixed rate period.

Often this minimum is designed to cover any costs associated with processing and servicing the loan here s one example.

For example an adjustable rate mortgage may have an interest rate floor stating that the rate will not go below 3 5 even if the formula used to calculate the interest rate would have it do so.

An interest rate floor reduces the risk to the bank or other party receiving the interest.

An example of a cap would be an agreement to receive a payment for each month the libor rate exceeds 2 5.

This is because the floor could be the interest rate effective during the fixed period or the interest rate that it first adjusted to.

There are three kinds of caps.

In other words even if interest rates decline substantially your new rate may not decline at all.

If your mortgage has a floor of 2 0 percent your interest rate will never drop below this even if its fully indexed rate is lower.

An interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price.

Take that same arm for 3 5 percent with a 3 percent floor.

An adjustable rate mortgage arm is a type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan.

Some arms have a floor interest rate below which the rate cannot go.

Similarly an interest rate floor is a derivative contract in which the buyer receives payments at the end of each period in which the interest rate is below the agreed strike price.

This cap says how much the interest rate can increase the first time it adjusts after the fixed rate period expires.

A variable rate mortgage adjustable rate mortgage arm or tracker mortgage is a mortgage loan with the interest rate on the note periodically adjusted based on an index which reflects the cost to the lender of borrowing on the credit markets.

Our 1 year arm has a rate of 4 25 2 6 caps margin of prime 1 and a floor of 4 25 so if we have a borrower and the ltv on the loan is between 50 65 then we will decrease their rate by 10 basis points to 4 15 which will make their floor rate 4 15 as well and the caps will remain the same and so will the margin.

Interest rate floors are often used in the adjustable rate mortgage arm market.

An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product.